- Lucas Woodley ’23 from Harvard critically examined the effectiveness of tax credits in reducing carbon emissions from electric vehicles (EVs), challenging conventional beliefs.

- Many EV owners, influenced by their driving habits, might inadvertently increase their carbon footprint, especially if the vehicle is underutilized.

- Woodley’s research suggests that for an EV to be environmentally beneficial in the U.S., it needs to cover a significant mileage to offset its production emissions.

- Policy recommendations from Woodley and Nunes led to the introduction of tax credits for used EVs, emphasizing the importance of long-term EV use and targeting rideshare drivers.

- Nature’s research and other studies highlight the complexities of EV adoption, emphasizing the need for a more targeted approach that considers user behaviors, vehicle utilization, and socioeconomic factors.

Lucas Woodley’s Research Journey

Lucas Woodley ’23 from Harvard began his journey by questioning the effectiveness of tax credits in reducing carbon emissions from electric vehicles (EVs). “We know EVs deliver environmental advantages under the right conditions, but what exactly are those conditions?” Woodley pondered. A significant revelation from Woodley’s research was that EV buying incentives often failed to deliver on the government’s investment.

Driving Habits and Carbon Footprint

Surprisingly, many EV buyers, due to their driving habits, end up increasing their carbon footprint. “If you’re someone who seldom drives, and the vehicle is mostly going to sit in the garage, then you may counterintuitively be better off owning a gasoline-powered vehicle,” Woodley commented. The batteries in EVs contribute significantly to emissions during the manufacturing process. To truly benefit the environment, an EV in the U.S. must cover between 28,069 and 68,160 miles to offset the emissions from its production.

Tax Credits and Policy Recommendations

Woodley’s research indicated that if the aggregate use of EVs is below 55,749 miles, they might not offer any emissions advantage over gasoline vehicles. Tax credits should be designed to promote long-term EV use, especially since low- and middle-income buyers tend to drive more miles relative to the number of cars they own. A policy memo by Woodley and Nunes in April 2022 suggested extending procurement incentives to the secondhand EV market. Shortly after, the Biden Administration announced tax credits for used EVs, reflecting some of their policy recommendations.

Economic Impact and Insights

Woodley’s thesis explored the economic impact of the very tax credits he advocated for, concluding that the value of used EV tax credits often benefited those selling their cars. “Lucas started off in a different place, with the much more conventional view that tax credits would benefit people with lower incomes. After a lot of hard work and analysis, he had quite a different conclusion,” remarked Vice Provost for Climate and Sustainability, James Stock. Woodley’s subsequent research proposed optimizing government spending on EV incentives, suggesting subsidies for workers like rideshare drivers who cover long distances.

Research Findings and Future Directions

Too many EVs are bought as secondary vehicles and remain unused, a finding Woodley presented at a National Bureau of Economic Research conference. Woodley’s ongoing research with Nunes delves into the emissions benefits of EVs across all 50 U.S. states, considering the diverse electricity grids and their green energy rates. They aim to discern in which states EV investments are least effective and how EV emissions benefits compare to hybrids. “For me, there’s always the question of how to improve environmental sustainability while recognizing the associated political and financial realities,” Woodley expressed his concerns about climate change.

Nature’s Research Insights

A paradoxical finding from Nature’s research suggests that using EVs as substitutes, especially in multi-vehicle households, might set tougher conditions for achieving an emissions advantage. Government-sponsored financial programs, known as procurement incentives, aim to encourage the electrification of privately-owned vehicles. However, using EVs as non-primary vehicles increases the longevity thresholds required for these vehicles to deliver an emissions benefit. “Our results suggest a more targeted approach is warranted, one that considers EV usage patterns and user behaviors,” the research emphasized.

Policy Recommendations and Implications

Transitioning from programs that reward EV adoption to those that reward utilization and reduce carbon emissions, such as subsidized charging costs, could be more effective. The researchers caution against viewing a more targeted vehicle electrification policy as a weakened response to transportation-related carbon emissions. Adjusting the magnitude of EV procurement incentives is essential for socioeconomic equity, especially since multi-vehicle households often have higher incomes.

Challenges and Opportunities

The researchers acknowledged uncertainties in their analysis, such as the phasing out of fossil fuel-powered electricity grids and reductions in EV production emissions. Their findings suggest that realizing emissions benefits from EVs requires reducing emissions from both fuel production and vehicle manufacturing. The National Bureau of Economic Research hosted a conference discussing the economics of energy use in transportation. ScienceDirect‘s study suggests that targeted EV procurement incentives can lead to efficient abatement cost outcomes.

Similar Post

Global EV Adoption

Trends Over the past two decades, various policies have been adopted globally to stimulate EV sales. The real advantage of EVs in emissions reduction is realized under specific conditions, especially concerning aggregate mileage and battery longevity. Grid decarbonization alone might not ensure efficient abatement cost outcomes for EVs. Private vehicle ownership, while beneficial for economic mobility, has significant negative externalities, contributing to climate change.

Financial and Environmental Considerations

The higher average upfront costs of EVs compared to fossil fuel-powered vehicles remain a challenge for widespread adoption. Governments globally have responded with EV procurement incentives, such as tax credits. The effectiveness of these incentives is under debate, especially considering public resistance towards federal subsidies and limited capital. Good governance requires not just emission reductions but maximizing reductions per dollar spent. Economic efficiency in EV adoption means comparing the carbon emissions reduction per dollar from incentivizing EV procurement with alternative CO2 abating policies.

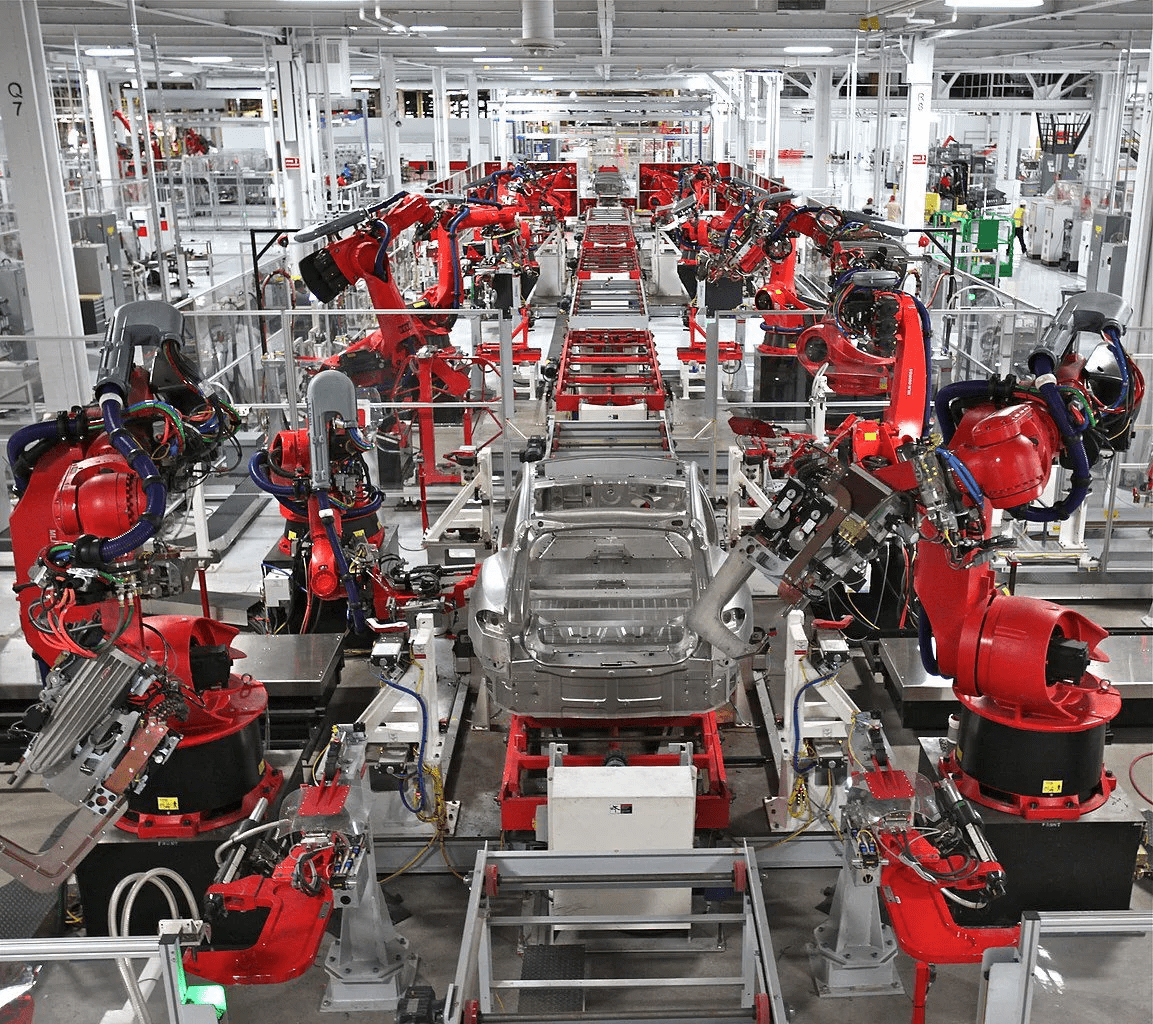

Technical Aspects of EVs

The emissions benefit of EVs depends on factors like manufacturing emissions, upfront costs, fuel use emissions, and operating costs. Aggregate vehicle utilization is a key determinant of the cost and emissions differences between EVs and ICEVs. Existing studies suggest that EVs might offer an emissions advantage over ICEVs after approximately 13,500 miles. Battery replacements play a significant role in determining the total cost of ownership and emissions of EVs.