The US Treasury Department has declared a list of electric vehicles (EVs) eligible for tax credits, and fewer models made it to the list than in previous years. The new law enables consumers to use up to $7,500 in tax credits for eligible EVs. Sixteen new models and some of their variations are eligible for all or half of the new credit, while nine models are no longer eligible.

The eligible cars are mostly made by the “big three” EV automakers in the US: Ford, General Motors, Stellantis, and Tesla. Hyundai and Kia’s EVs are excluded from the list of 16 EVs that are eligible for the federal tax credit of up to $7,500. The Inflation Reduction Act, which became law in 2022, requires carmakers to add the final assembly process on American soil to receive the tax credits.

The US government has issued an updated list of all-electric and gas-electric hybrid vehicles that qualify for the tax credit, and those that can earn at least a partial sweetener for buyers. To claim the full $7,500 tax credit, a percentage of the pre-determined battery parts must be made in North America, and a percentage of critical minerals must be sourced in the US or from certain trade-friendly countries.

A partial $3,750 credit is available for meeting one of these two battery-sourcing requirements. Nine models, mostly from foreign brands, including Hyundai and Nissan, do not qualify for the new tax credit.

Used EVs qualify for less of an overall tax credit and also come with certain income requirements. Leased vehicles can also qualify for a $7,500 tax credit without some of the strict rules about the car’s batteries and final assembly.

Fueleconomy.gov will host the updated list of eligible new and used EVs. The electric vehicles that meet the criteria can be sold with no limit on the number of tax credits. Some of the previously eligible cars were removed under the new rule. However, officials have mentioned that more cars will be added to the list.

Models eligible for the new EV tax credit

- 2022-2023 Chrysler Pacifica PHEV

- 2022-2023 Jeep Wrangler PHEV 4xe

- 2022-2023 Jeep Grand Cherokee PHEV 4xe

- 2022-2023 Ford F-150 Lightning (standard and extended range)

- 2022 Ford e-Transit

- 2022-2023 Ford Mustang Mach-E (standard and extended range)

- 2022 Ford Escape Plug-in Hybrid

- 2022 Lincoln Corsair Grand Touring

- 2023 Lincoln Aviator Grand Touring

- 2022-2023 Chevrolet Bolt

- 2022-2023 Chevrolet Bolt EUV

- 2023-2024 Cadillac LYRIQ

- 2024 Chevrolet Silverado EV

- 2024 Chevrolet Blazer EV

- 2024 Chevrolet Equinox EV

- 2022-2023 Tesla Model 3 Standard Range RWD

- 2022-2023 Tesla Model 3 Performance

- 2022-2023 Tesla Model Y AWD

- 2022-2023 Tesla Model Y Long Range AWD

- 2022 Tesla Model Y Performance

- Senate’s Student Loan Overhaul Adds 10 Years to Repayment and Caps Graduate Borrowing at $100,000

- AI Chatbots Generate 88% False Health Information When Manipulated, New Study Warns

- Australia Issues Terror Warning for Thailand: 11 Explosive Devices Found in Popular Tourist Areas

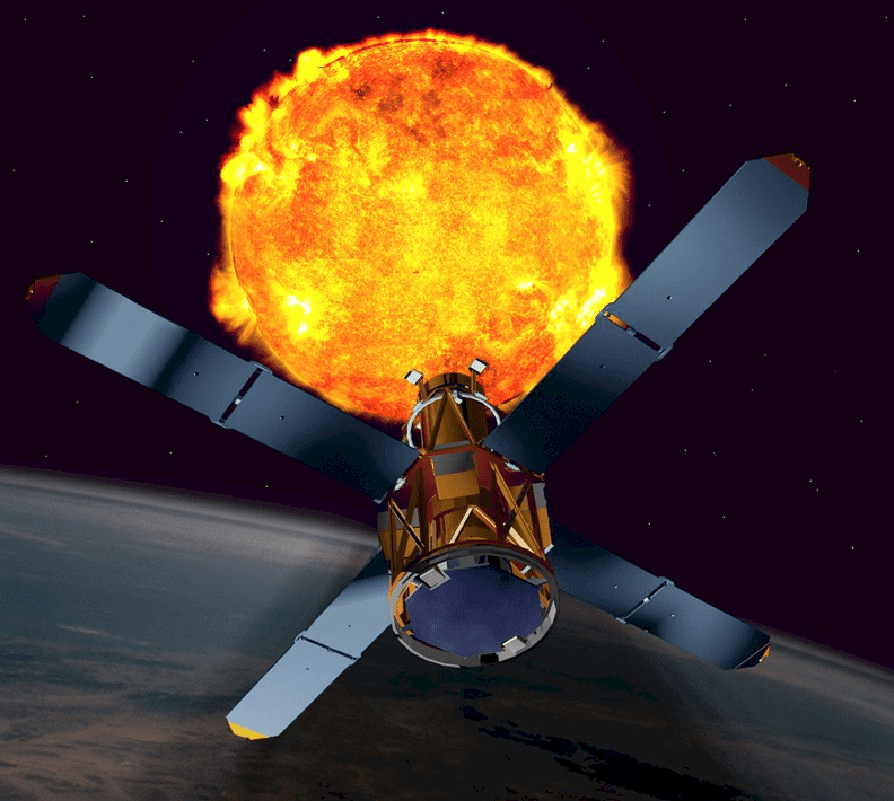

- Space Station Crosses Sun During Solar Flare: McCarthy’s ‘Kardashev Dreams’ Photo Stuns Viewers

- Bank of England’s First Major Banknote Redesign Since 1970 Seeks Public Input on £86 Billion Currency

The new Treasury rule on EVs comes from the Inflation Reduction Act, which aims to move the supply chain for critical minerals needed for EV batteries and other clean energy technology away from China. New strengthened requirements mandate car companies receive tax credits by assembling their vehicles on US soil using more than 50 percent of battery parts manufactured and assembled in the US.

Some automobiles are eligible for another $3,750 tax credit. Eligible vehicles should be built with 40 percent of key materials produced in the US or other countries with free trade agreements with America.