In a calculated move to counter mounting Chinese competition and accelerate its electric vehicle capabilities, Volkswagen has finalized a $5.8 billion investment in Rivian Automotive, expanding their initial $5 billion partnership announced in June 2023.

The partnership materialized after a telling test drive in Palo Alto last August, where VW executives examined a modified Audi EV retrofitted with Rivian’s advanced over-the-air update capabilities. The vehicle demonstrated wireless control updates for systems ranging from air conditioning to rear-axle steering – capabilities that caught the attention of VW’s engineering team.

Technical Integration and Joint Venture Structure

The newly formed Rivian and Volkswagen Group Technologies LLC, a 50-50 joint venture, will be co-led by Rivian’s head of software Wassym Bensaid and VW’s chief technical engineer Carsten Helbing. The venture will employ approximately 1,000 engineers from both companies, initially based in California with plans for expansion to additional sites across North America and Europe.

VW has already invested an initial $1 billion through a convertible note, gaining access to Rivian’s sophisticated onboard computing hardware and software infrastructure – technology that Rivian developed with billions in R&D investment for its electric pickup trucks and SUVs.

Michael Steiner, VW’s head of research and development, stated plainly: “We have to overcome our pride and accept that we will no longer master every technology ourselves.”

Financial Context and Market Impact

The timing proves crucial for both automakers:

- Rivian’s shares declined 55% in 2024, with the company reporting $39,000 losses per vehicle in Q3 2023

- The company’s market value stands at $10.8 billion

- Construction at Rivian’s $5 billion Georgia factory remains paused since March

- VW faces its own restructuring challenges, implementing a $4.3 billion cost-reduction plan including closure of three German factories

Product Timeline and Integration Plans

The partnership sets specific launch targets:

- Rivian’s R2 vehicle: First half of 2026.

- First VW Group models with integrated Rivian technology: 2027.

- Initial focus includes Scout Motors electric pickup and SUV lines.

Rivian CEO RJ Scaringe elaborated on the financial strategy during their recent earnings call: “The proceeds we anticipate receiving following the formation of the joint venture and certain milestones, together with our $6.7 billion of cash, cash equivalents, and short-term investments, are expected to fund Rivian’s capital roadmap for growth.”

More Stories

Market Analysis and Future Outlook

CFRA Research senior equity analyst Garrett Nelson points to persistent challenges: scale limitations, intensifying competition, high capital costs, and potential elimination of EV tax credits. However, Canaccord Genuity analysts suggest the joint venture addresses “a significant chunk of the capital concern” and could establish the partnership as a dominant platform in Western markets alongside Tesla.

The collaboration extends beyond VW’s recent strategic moves in the EV space, following its $700 million investment in Chinese EV maker Xpeng and subsequent plans for joint EV development targeting the Chinese market’s cost-effective, tech-forward models.

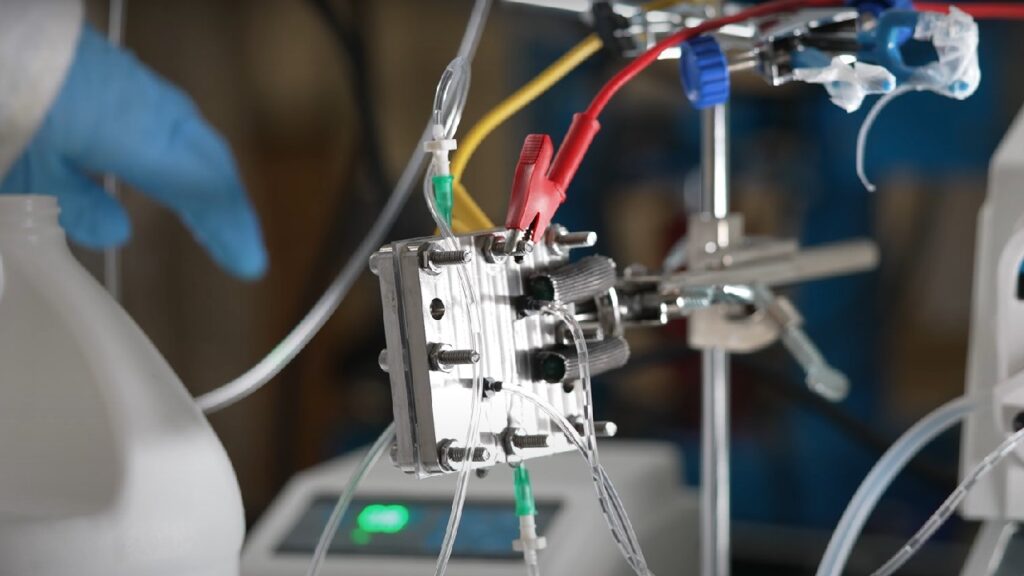

Initial results show promise – the joint venture has already produced a functional demonstration vehicle, though specific technical details remain proprietary. Both companies emphasize the partnership’s focus on reducing development costs while accelerating technology scaling, particularly in automated driving functions and over-the-air update capabilities.