The Eighth Circuit Court of Appeals put legal challenges to the SEC’s climate disclosure rule on hold Friday, waiting for the agency to clarify its plans for the controversial regulation. The court’s order creates more uncertainty for companies caught between changing federal requirements and ongoing investor demands for climate transparency.

“It is the agency’s responsibility to determine whether its Final Rules will be rescinded, repealed, modified or defended in litigation,” the court wrote in its order. The judges noted that since the SEC had already delayed the rule’s effective date, pausing the court case wouldn’t cause additional harm.

The climate disclosure rule, adopted in March 2024, would require public companies to report climate-related risks, greenhouse gas emissions (Scope 1 and Scope 2 for certain filers), and material expenditures and financial statement impacts related to climate mitigation or adaptation. Republican-led states and business groups immediately sued to block it, arguing it exceeded the SEC’s authority.

In a dramatic shift, the SEC under President Trump’s administration voted in March 2025 to stop defending the rule in court. Acting Chair Mark T. Uyeda called the rules “costly and unnecessarily intrusive” for businesses. This unusual move came after the agency had already voluntarily paused implementing the rule when the lawsuits began.

The SEC now finds itself in an awkward position. In July 2025, the agency told the court it doesn’t plan to reconsider the rule now but still wants the court to rule on its merits. Most commissioners believe the SEC lacked authority to issue the rule, yet they’ve asked the court to decide the case rather than formally rescinding it.

Similar Posts

Commissioner Caroline Crenshaw has sharply criticized this approach, accusing the SEC majority of “letting the Climate-Related Disclosures Rule stand but withdrawing from its defense” and attempting to “unlawfully” dismantle it through political means. When the SEC filed its July status report, Crenshaw described the response as “wholly unresponsive” to the court’s questions.

Republican leaders on the House Financial Services Committee characterized the SEC’s withdrawal as a significant shift and evidence of regulatory overreach. The case has unfolded amid changing market dynamics. Environmental and social shareholder proposals fell by approximately 55% in early 2025 compared to 2024, dropping from 206 to 92 proposals.

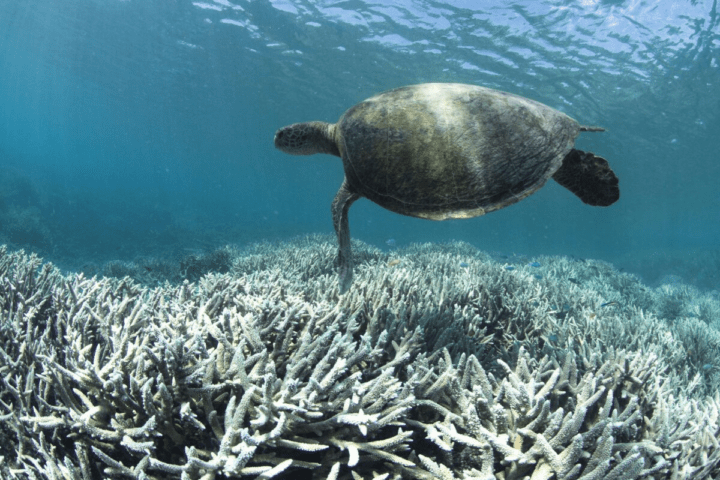

Despite federal uncertainty, companies still face pressure to disclose climate information. The European Union’s sustainability reporting rules and California’s climate laws continue to push for transparency. Investor advocates like Ceres highlight that investment firms managing $50 trillion in assets support climate disclosures.

Democratic state attorneys general have stepped in to defend the rule after the SEC withdrew, creating an unusual situation where states are defending federal regulations instead of the agency that created them.

For businesses, this limbo extends an already lengthy period of uncertainty. Legal experts advise companies to maintain climate risk reporting aligned with existing guidance and international frameworks. Many large companies already voluntarily report emissions and climate risks to meet investor expectations, regardless of federal requirements.

The case, known as Iowa v. SEC, remains in suspended animation – with the rule stayed but not rescinded – while everyone waits for clarity on the future of climate disclosure standards in U.S. financial markets.