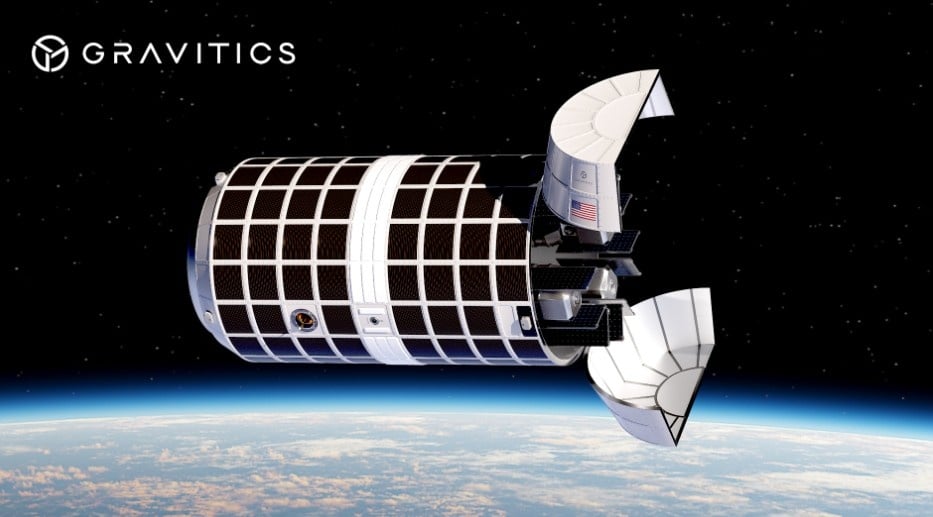

The United States Space Force has tasked Gravitics with developing what aerospace engineers call an orbital aircraft carrier – a 60 cubic meter spacecraft designed to park satellites in orbit for tactical deployment. The contract, worth up to $60 million through the Strategic Funding Increase (STRATFI) program, combines government funds, SBIR funds, and private investment to create what industry insiders are calling a pre-positioned satellite launch platform.

The spacecraft specs show an unpressurized cylindrical module with a 5,000-10,000 kilogram launch mass. Wrapped in solar panels, this cargo bay will store multiple satellites that can be deployed based on tactical needs. “The Orbital Carrier is designed to pre-position multiple maneuverable space vehicles that can deliver a rapid response to address threats on orbit,” according to the official announcement from Gravitics.

Aerospace analysts point to this as a shift in how space forces operate. Traditional military satellite launches typically take weeks or months to execute. The Space Force’s recent Victus Nox mission demonstrated rapid launch capabilities – getting a satellite from warehouse to orbit in just 27 hours. Now they’re looking to eliminate launch windows entirely by keeping satellites ready in orbit.

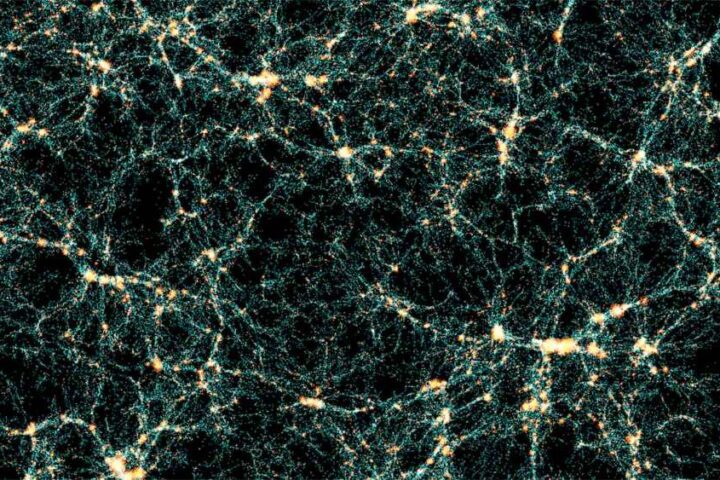

Vice Chief of Space Operations Gen. Michael Guetlein briefed defense industry officials about growing threats in March 2025 at the McAleese Defense Programs Conference. He specifically noted China’s advancement from what military strategists call a “Kill Chain” to a “Kill Mesh” – an integrated network combining intelligence, surveillance, and weapon systems. Space domain awareness experts have observed Chinese satellites demonstrating autonomous rendezvous and proximity operations, with five objects performing synchronized maneuvers that space warfare specialists call “orbital dogfighting.”

The military space community is watching these developments closely. Guetlein reported that commercial space surveillance assets captured the Chinese Shiyan-24C experimental satellites conducting these exercises in low Earth orbit. “We observed five objects in space moving in and out and around each other in synchrony and in control,” Guetlein said. These maneuvers demonstrate advanced counterspace capabilities that could target U.S. assets.

Gravitics’ orbital carrier leverages their commercial space station technology. The company, which secured a $125 million contract with Axiom Space for commercial modules, is applying their large structure expertise to national security applications. Their flagship StarMax module offers 400 cubic meters of pressurized volume – nearly half the International Space Station’s capacity in a single unit.

The Space Force’s strategy now emphasizes space superiority through what General Chance Saltzman calls “space control.” At the Air and Space Forces Association Warfare Symposium, Saltzman outlined this new approach: “Space superiority is our prime imperative… and we do not yet have the service we need.” The doctrine includes both defensive and offensive operations in orbital space.

Similar Posts

Gravitics’ technological approach uses modular spacecraft ranging from 3 to 8 meters in diameter. Their commercial products are compatible with launch vehicles like SpaceX’s Falcon 9, ULA’s Vulcan, and Blue Origin’s New Glenn. This versatility allows the military to leverage commercial launch infrastructure while developing dedicated space warfare capabilities.

The orbital carrier project follows Gravitics’ $1.7 million SBIR contract from April 2024, where they adapted their space station architecture for tactically responsive operations. SpaceWERX, the Space Force’s innovation division, has invested over $897 million across 1,106 contracts since August 2021 to strengthen the defense industrial base.

Industry experts note this shift toward in-space operations represents a new phase in military space doctrine. Traditional approaches focused on rapid ground launches to replace disabled satellites. The orbital carrier adopts a preemptive posture by positioning deployment platforms in strategic orbital zones, reducing reaction times from hours to minutes for satellite replacement.

Recent space domain awareness reports show adversaries developing sophisticated counterspace capabilities. These include grappling arms that can tow satellites, directed energy weapons, and co-orbital systems that can jam or damage space assets. Guetlein noted that what the space community once considered “gentlemen’s agreements” against interfering with satellites are eroding.

The Outer Space Treaty of 1967 prohibits nuclear weapons in space but doesn’t specifically address conventional military systems. Space warfare analysts point out this legal ambiguity as nations develop orbital platforms with dual-use capabilities. The U.S. approach combines commercial infrastructure with military applications, creating resilient architectures that can withstand attacks through proliferation and redundancy.

Gravitics plans to demonstrate their orbital carrier platform by 2026. The company’s dual-use strategy mirrors broader industry trends where commercial space capabilities directly support national security objectives. As Colin Doughan, Gravitics CEO, explained: “It bypasses traditional launch constraints, enabling space vehicle operators to rapidly select a deployment orbit on-demand.”

Space industry forecasters predict this shift toward orbital operations will define the next decade of space warfare. With China adding 20 intelligence, surveillance, and reconnaissance satellites every six months, and developing their G60 communications constellation of 14,000 satellites by 2030, the Space Force is adapting its doctrine to maintain technological superiority. The orbital carrier represents this evolution – from reactive space operations to proactive space dominance.

The aerospace sector expects continued integration between commercial and military space capabilities. Gravitics’ StarMax module technology, designed for commercial space stations, demonstrates how dual-use systems can address both civilian and defense needs. This convergence may define the next era of space infrastructure development, where the lines between commercial operations and national security blur in humanity’s newest operational domain.