In the field of clean energy the United States has been found on the back foot for quite some time. The reason for this backwardness is the abundance of inexpensive oil & gas from the West Texas Permian Basin & deeply ingrained economic & cultural support for the petroleum industry. But there are signs of inevitable growth of the lithium industry in the US.

All the efforts are being done by the Biden administration to level with countries like China & Europe. The Environmental Protection Agency has acknowledged the Inflation Reduction Agency Act, which was passed last year, as the most advanced climate law in US history. This Act provides far-reaching financial aid for the domestic renewable energy industry. It has a budget of $370 billion as subsidies for solar, wind, & electric vehicle production.It is estimated to decrease greenhouse gas emissions by 40 % below 2005 levels by 2030.

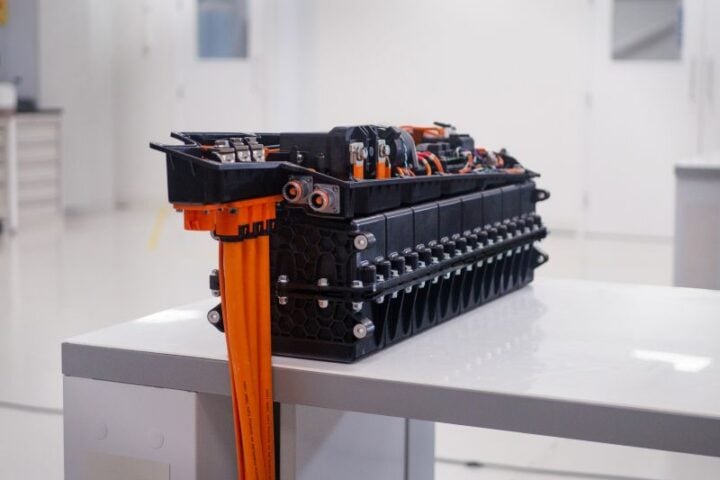

Of course there are many significant impediments in the path of a quick growth in the fields of electric vehicle & renewable energy. Recruitment of enough workers in a job market is one such challenge. Lithium is another obstacle as it is a main component in the batteries that power electric vehicles . Lithium is also needed to store energy generated by renewable sources such as wind & solar. Australia, Chile, China are a few contenders who dominate the global supply of lithium. At present there is only one operating lithium plant in the US, though the country has some of its lithium reserves. The Silver Peak facility in Nevada is the name of a lithium plant. It is crucial & urgent for the US to develop more domestic lithium production, so that the country is able to increase production of electric vehicles & renewable energy without relying on China for lithium.

The Inflation Reduction Act has outlined the map of growth of the renewable energy sector which will keep pace with the demand & supply of lithium for which the federal government has invested heavily in lithium producers. The US Department of Energy has committed conditionally a loan of $700 million to an Australian lithium company viz Ioneer. The CNBC has reported that the company’s primary project will be located in Nevada, at the Rhyolite Ridge Lithium-Boron Project in Esmeralda County, which is set to produce enough lithium for 400,000 electric vehicles & also to produce boron. The Inflation Reduction Act has pushed creation of plants, one of which is the Rhyolite Ridge Project(RR). This is followed with the announcement of lithium production centers in North Carolina & Tennessee.

- Deadly Legionnaires’ Outbreak Returns to London Ontario: 43 Cases, 1 Death Within 6km Zone

- Minnesota Air Quality Crisis: 2nd Purple Alert of 2025 as Canadian Wildfire Smoke Blankets Entire State

- Tesla Slashes Model Y Price by $20K to Revive Canadian Sales

- How Your First Date Outfit Affects Power Dynamics Without You Knowing

- Decorate With Light: Stunning Ideas Using Landscape Lighting Services

Even before the starting of operation of the RR plant in Nevada, major EV manufacturers such as Ford & Toyota have already secured offtake agreements with Ioneer. This highlights the increasing concern that there may not be enough lithium to sustain the growth of EVs & short-term renewable energy storage. We can understand this anxiety as estimates show that the world’s lithium supply would be exhausted within fifty years if all gasoline-powered cars are replaced with EVs overnight. Even renewable technologies rely on finite resources. Only 1% of cars on American roads are electric. However, the global number of EVs is estimated to soar in the next decade, crossing the landmark of 125 million by 2030.