The US Department of Commerce launched antidumping and countervailing duty investigations into Indian solar panels on August 7, 2025. This move threatens US imports from India that increased from $83.9 million in 2022 to $792.6 million in 2024, roughly a tenfold rise.

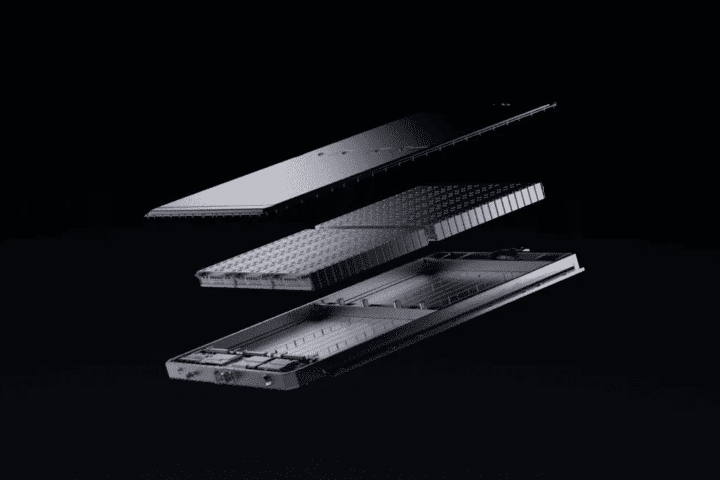

American trade officials are examining crystalline silicon photovoltaic cells and modules from India, with petitioners alleging a dumping margin for India of 123.04%. The investigation covers both standalone cells and fully assembled panels under tariff codes HTSUS 8541.42.0010 and 8541.43.0010.

What matters most to Indian suppliers is the enormous exposure – import data shows shipments to America jumped from 232.4 million watts ($83.9 million) in 2022 to 2.30 billion watts ($792.6 million) in 2024.

Commerce states the scope covers CSPV cells “whether or not assembled into modules,” meaning everything from basic cells to complete panel systems falls under scrutiny.

USe quotes block

This case emerges just as India aims for its ambitious 500 GW renewable energy milestone and after solar PV investment worldwide eclipsed $500 billion in 2024, outpacing all other energy sources combined.

The Alliance for American Solar Manufacturing and Trade filed these petitions, representing domestic producers Hanwha Q CELLS USA Inc., First Solar Inc., and Mission Solar Energy LLC. Petitions allege subsidy rates above de minimis (less than 2% for developing countries).

The case follows a strict timeline as documented by the US Department of Commerce. The ITC completed and filed its determinations in these investigations on September 2, 2025, as confirmed in the Federal Register notice published September 5, 2025. Commerce scheduled its preliminary determinations for October 13, 2025 (CVD) and December 26, 2025 (AD), subject to statutory extensions.

According to the September 5 Federal Register notice, parties that filed entries of appearance in the preliminary phase of the investigations need not enter a separate appearance for the final phase. The notice also states that industrial users and representative consumer organizations have the right to appear as parties in Commission antidumping and countervailing duty investigations.

USe quotes block

This case comes amid broader industrial developments, including Odisha’s ₹84,918 crore industrial surge where green energy leads the charge, highlighting the growing importance of renewable manufacturing to India’s economic ambitions.

The timing is particularly challenging as Vikram Solar shares recently saw modest gains after IPO, demonstrating the growing but still vulnerable nature of India’s solar manufacturing sector.

If both investigations result in duties, importers will need to post cash deposits based on preliminary rates once announced. As noted in the Federal Register, the Director of the Office of Investigations will circulate draft questionnaires for the final phase of the investigations to parties to the investigations.

USe quotes block

India’s Ministry of New and Renewable Energy (MNRE) has yet to issue a formal response, though the probe comes at a critical juncture when solar and wind power drove a record 30% renewable electricity surge worldwide in 2023.

This development creates an interesting dynamic alongside India’s underground coal ambitions targeting triple production by 2030. The country continues pursuing multiple energy strategies while its renewable manufacturers face headwinds in export markets.

The investigation covers products under HTSUS 8541.42.00 and 8541.43.00, with potential duties adding to existing import charges.

According to the US Department of Commerce Enforcement and Compliance division, these investigations were initiated on August 7, the ITC completed and filed its determinations on September 2, 2025, and Commerce preliminary determinations are scheduled for October 13 (CVD) and December 26 (AD), subject to extension. US imports from India reached 2.30 billion watts ($792.6 million) in 2024, showing the significant market at stake.